If 2025 was an earthquake for the global economy, the epicenter was undoubtedly the White House.

On April 2, U.S. president Donald Trump announced the launch of large-scale “reciprocal tariffs.” Once the news came out, corporate pricing, inventories, procurement rhythms, and market expansion plans were thrown into disarray. The U.S. and China quickly entered a cycle of retaliation and counter-retaliation, straining cross-border supply chains and plunging the entire world into unprecedented uncertainty.

Half a year later, countries were stuck at the negotiating table, while businesses were struggling to adjust their survival strategies under mounting cash flow pressure. In such an environment, any system that can reduce costs and improve cash flow flexibility has become more important than ever.

Precisely at this time, a mechanism that had been overlooked for more than 200 years was once again discussed: “duty drawback.”

“Many companies don’t even know that the tariffs they pay are refundable,” said Penny Chen, founder of Pax, a startup that uses AI to help companies reclaim taxes. In her interviews with clients, she sees the same thing over and over again: companies pay tens of billions of dollars in tariffs to the government every year, and only about 20 percent of that money is actually refunded. The remaining 80%—amounting to nearly $15 billion—just sits there unclaimed. “It’s free money left on the table!” she added with a sense of helplessness.

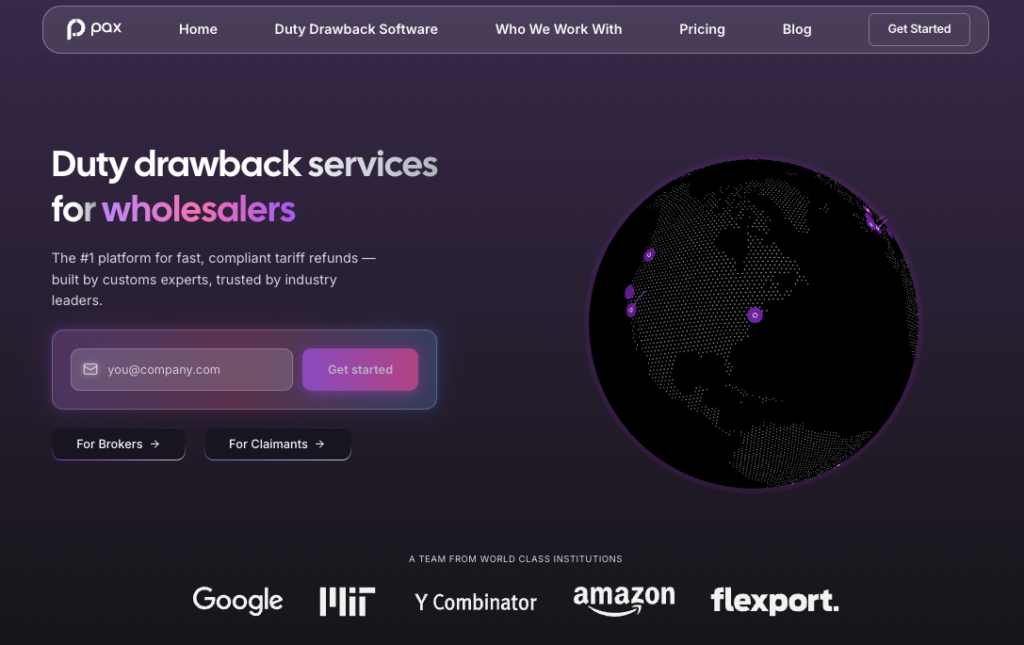

This huge disconnect unexpectedly became an entry point for Pax. With AI at its core, Pax uses algorithms to help companies identify 15% more refundable tariffs than traditional service providers, streamlining processes that would otherwise take more than six months to just over ten working days. For the first time, organizations are realizing that AI tools can transform tariff refunds from a burdensome process into an immediate source of cash flow.

Image credit: Pax LinkedIn

Companies Don’t Have to Overpay Tariffs! But Who Is Eligible for a Refund?

A “duty drawback” is a refund administered by U.S. Customs and Border Protection (CBP) that allows businesses to recover import duties they have already paid; it is distinct from the more familiar income tax refund. Under U.S. law, any business that has paid duties on goods imported into the United States can recover part or all of the duties if the goods are subsequently re-exported, re-exported after processing, or destroyed within the United States, among other qualifying conditions.

The most common case comes from the manufacturing industry: if a company imports raw materials from overseas, processes them in the United States, and then exports the finished products, the tariffs previously paid can then be refunded in accordance with U.S. law. Another typical example comes from

Another typical example involves retailers and distributors: if a company imports merchandise from overseas and re-exports it without selling or using it in the United States, the duties previously paid can also be refunded under U.S. law.

Cross-border e-commerce companies and large retailers, which have grown rapidly in recent years, are also frequently eligible for tax refunds. Shipments moved from within the U.S. to overseas warehouses are considered exports. If a consumer returns shipped goods that are then destroyed in the U.S., duties on those goods can also be recovered.

In other words, many routine logistics operations, such as moving warehouses, returning goods, or destroying products—which on the surface may not seem directly related to revenue—can in fact be a source of substantial tax rebates. As long as companies can clearly track the flow of their goods, they can reclaim funds that already belong to them.

Complicated Processes and Outdated Tools: Why Traditional Tariff Refunds Are So Difficult

Although the system itself is not difficult to understand, the high complexity of implementation is the most challenging aspect for companies. Penny Chen explained that, in addition to different commodities and various import and export scenarios, a bigger headache is that the information required for tariff refunds is often scattered across PDFs, Excel files, and ERP systems. Companies are tasked with organizing data from piles of invoices, customs declarations, and logistic records—which use different formats and layouts—into the specific format required by government agencies, an extremely time-consuming process.

Due to this complexity, many companies choose to outsource to specialized service providers, but this does not necessarily make the problem any simpler. Traditional providers continue to rely on software that has been in use for more than 20 years, and the process still depends heavily on manual labor. Each case has to be manually entered and compared line by line, and a company applying for a refund for the first time may need to wait an entire year from the time it submits the relevant documents to when it actually receives the refund.

Because the process is so cumbersome and slow, many service providers are only willing to take on large clients with potential refunds of $100,000 or more per year. As a result, even though SMEs are eligible for tariff reimbursement, they are often unable to find anyone who is willing to handle their cases.

“This Is a Fun Math Problem!” How Pax Uses Algorithms to Help Companies Recover 20% More in Tariff Refunds

Chen’s earliest exposure to tariff refunds came when she worked as a researcher at Flexport. She quickly realized that the process involved extensive data cleansing and rule comparison. Through exchanges with industry experts, she sought to understand the market’s real pain points. “I found that everyone’s dilemma was almost exactly the same,” she said. “They were eligible to recover the tariffs they had already paid, but because they didn’t understand the system, they didn’t have the tools, or they couldn’t find providers who were willing to support them, they ended up with nothing.”

Penny Chen holds a Ph.D. from the Massachusetts Institute of Technology (MIT), where she specialized in algorithmic design. “From my point of view, tariff refunds are actually a very interesting mathematical problem—it’s just that no one has ever approached them algorithmically!”

Image credit: National Taiwan University Department of Mechanical Engineering Newsletter

Simply put, Pax is like TurboTax for corporate tariff refunds. TurboTax, the most widely used tax filing software in the United States, breaks down complicated rules into a standardized process that allows taxpayers to file returns with a single click. Pax aims to re-create the same experience for corporate tariff refunds, helping businesses reclaim tariffs without needing to understand the rules, organize the data, or waste time and money on a long, drawn-out process.

However, the first and most difficult step in achieving this is addressing a fundamental pain point: “fragmented data.”

Currently, service providers handling tariff refunds spend most of their time manually preparing data. To proceed to the next steps, companies often have to submit all necessary documents up front, requiring them to be organized in a uniform format. This stage alone demands a significant amount of time and manpower, and it’s the reason why most companies find their first experience with tariff refunds so frustrating.

Pax’s approach eliminates this “manual review” step. Companies no longer need to prepare any documents in advance; they simply provide the raw data to Pax, and the system automatically reads and extracts the relevant information, transforming unstructured data into structured, calculable formats, thus saving countless hours.

The next step is the algorithm. Chen and her team design their own algorithms that enable the system to identify which permutations will maximize tariff refunds. Many businesses, after submitting their cases to Pax for calculation, have been able to recover an additional 15% to 20% compared with the amounts previously determined through manual review.

The final step is actually submitting the information. After calculating the refundable amount using its algorithm, Pax has its in-house tax experts verify the results and then submits the documents directly to the government. Because Pax is authorized for U.S. submissions, the entire process eliminates the need for the traditional iterative submission process.

Under this model, processes that used to take six months to a year for companies can now often be completed in just 10–15 working days, resulting in a significant efficiency boost.

A Niche but Overlooked Market, Reimagined by AI

Tariff refunds have long been regarded as a fringe aspect of the trade system, but in reality, they are part of a system that has existed for over 200 years, involving the entire cross-border supply chain of import, processing, and export. Any company engaged in import and export activities may be eligible for refunds, meaning that the range of industries covered is far broader than generally imagined.

That’s why it’s a mature but fragmented market: even though more than a dozen service providers in the U.S. have been operating for years, the process is still highly dependent on manual labor, leaving a large volume of eligible refunds untouched for long periods—like forgotten “sleeping cash” waiting to be reawakened.

Pax tackled this problem by combining algorithms with experienced domain experts. Within just over a year of its founding, it was selected for Y Combinator, a leading Silicon Valley accelerator, received $4.5 million in early stage investment, and processed tariff refunds totaling around $10 million. Following Trump’s tariff announcement this year, demand from businesses surged, and Pax’s revenue tripled as a result.

With a team of fewer than 10 people at its founding, Pax achieved these results not only through the strength of its product but also thanks to favorable policy conditions. The evidence is clear: there is a huge and vastly undervalued market for “duty drawback,” and Pax is leading the way in addressing this gap.

Looking ahead, Penny Chen points out that the United States has adjusted the relevant laws and regulations numerous times. This system, which has existed since the founding of the nation, has been continuously revised over the past two centuries, becoming increasingly complicated as a result. “I think tariffs will only continue to increase,” Chen said. Amid supply chain restructuring and geopolitical tensions, it is difficult for companies to go back to the past, and the demand for tariff refunds is only likely to grow stronger.

In a rapidly changing world, “duty drawback” deserves to be better understood and more effectively utilized than ever before. Chen expects that through AI and automation, Pax can help businesses of all sizes transform what was once a cost burden into cash flow resilience, giving them greater control in the new economic landscape.